Nvidia’s Acquisition of Run:ai to Be Reviewed Under EU Merger Regulations.

The European Union has thrown a wrench in the works of chipmaker Nvidia's proposed acquisition of Tel Aviv-based AI workload management startup Run:ai.

The European Union has thrown a wrench in the works of chipmaker Nvidia's proposed acquisition of Tel Aviv-based AI workload management startup Run:ai. The deal, which was announced back in April — with a price tag of $700 million per our sources — will be reviewed by the bloc after a request by competition regulators in Italy under the EU Merger Regulation (EUMR).

Nvidia can't close the deal until it notifies and gets the nod from the Commission. So, at a minimum, the referral may add a few weeks to its timeline for completing the deal. However, if the preliminary check by the EU finds specific issues of concern, the bloc may move to a deeper investigation — which could add months of delay and uncertainty.

This does not fall under the standard notification thresholds under the EUMR but EU law has established an exception whereby a national regulator may notify a transaction to the Commission if they assess it to pose serious risks for competition locally and can, therefore, affect the trade within the Single Market of the bloc.

Italy filed a referral request to the Commission under Article 22(1) of the EUMR. This Article gives Member States the opportunity to request the Commission to review a merger that has no EU dimension but still affects trade within the Single Market and risks significantly impairing competition within the territory of the Member State(s) making the request," the Commission said in a Thursday press release.

The acceptance of the referral by the EU means that it agrees the proposed transaction meets the criteria for referral under Article 22.

In particular, the transaction threatens to significantly affect competition in the markets where NVIDIA and Run:ai are active, which are likely to be at least European Economic Area-wide and therefore include the referring country Italy, the EU wrote. The Commission also concluded that it is best placed to examine the transaction given its knowledge and case experience in related markets.

It asked the chipmaker, Nvidia, to notify the transaction-this is a formal step; the chipmaker needs to prepare documentation for the competition enforcers in the bloc to enable them assess the impacts of the merger.

For decades, Big Tech enjoyed nearly no regulation of its killer acquisitions of startups and smaller rivals, but over the last few years, there has been a sea change in the approach from regulators, who finally realized sitting on their hands for such a long period allowed a few platform giants to gobble up almost all the market power.

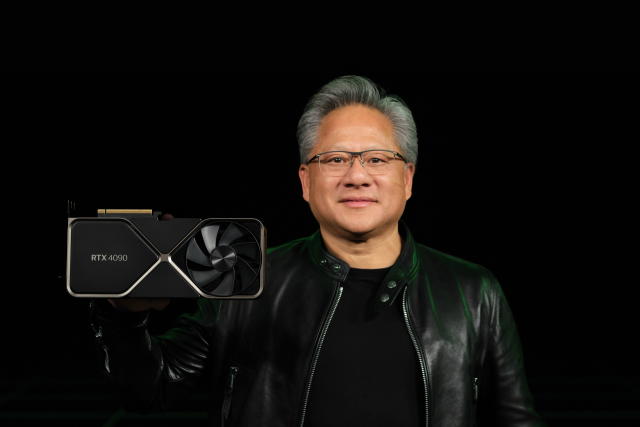

With AI, the new software space on which innovation will increasingly depend on access to relatively few critical inputs — for example, GPUs, custom-made by Nvidia to train the models — the specter of speedy repeat of the market-concentration problem has spurred heightened speed by antitrust authorities.

While nothing much has been done till date, it will be highly interesting to see what conclusions the Commission draws here from its review.

A spokesperson for Nvidia emailed a statement responding to the merger review from the EU. "We are happy to respond to any questions that the regulators may have about Run:ai," the company said. "Once the deal closes, we will continue to provide AI on every cloud and enterprise and will help our customers to select any system and software solution best suited to their needs."